Correction on the cards for fragile housing market

Tobias Newton

Equity Analyst, Octagon Asset Management

First published by NBR on 29 March 2022

ANALYSIS: History suggests the price weakness will have knock-on effects for dwelling consents and property developers.

Where we came from

The boom in New Zealand’s property market has been extremely well publicised over the past two years. To recap, between March 2020, when NZ first went into lockdown, and November 2021, when the market peaked, prices rose an astonishing 40% nationwide.

This rise in house prices helped to stimulate our economy in a number of ways. Directly, through increased construction activity and demand for real estate related services but also indirectly, as positive wealth effects from growing household equity were transmitted through the economy, supporting robust demand from the household sector. Spending on renovations and a broad range of consumer goods more than offset weaker tourism activity and saw our economy grow beyond pre-Covid levels through 2021.

Among the commonly cited explanations for the rapid increases in house prices is the idea of an under-build in housing creating a significant shortfall in supply relative to population growth (particularly in Auckland).

‘Spending on renovations and a broad range of consumer goods more than offset weaker tourism activity.’

This argument is not without merit, particularly over the longer term. However, when we look overseas, this rapid growth in house prices has been a global phenomenon. For example, prices in most Australian capital cities have increased 20-30% over the past 12 months. Similarly in the US and Canada national house prices are some 30-40% higher than they were at the start of the pandemic. Closer to home, places such as Invercargill and Kawerau have seen prices rise by 36% and 37% respectively from March 2020 to the November 2021 peak, despite minimal population growth over the past 25 years. Kawerau, for example, has seen its population fall by 5.5% since the mid-90s.

Global factors

Clearly there are other global factors at play influencing house prices rather than any localised shortfalls in house building. Understanding these factors can guide our expectations from here as our housing market and economy continue into the next stage of the market cycle.

These factors include:

- monetary stimulus by the RBNZ and other central banks cutting interest rates to near zero, sending mortgage rates to historic lows;

- relaxation of loan-to-value ratios (LVRs) increasing the availability of credit;

- an accumulation in savings as fiscal support and limited ability to spend on travel and services saw household savings increase; and

- inflows of capital into housing as returns from bank deposits fell to near zero.

The effect of the above factors was a significant increase in housing demand and both sales volumes and prices increased rapidly. Listings fell to all-time lows as vendors had little incentive to sell with prices rising. In turn, this drove frenzied competition from increasingly desperate bidders over very few homes.

From March 2021, investor activity slowed down as LVRs were reintroduced and interest deductibility changes were affected.

At the same time, the economy strengthened, and interest rates started rising. The number of listings remained low, supporting continued price growth, driven largely by owner-occupiers.

In late 2021, many mortgage rates rose above pre-Covid levels, with prices and loans for new buyers some 40% higher. The implementation of new Credit Contracts and Consumer Finance Act (CCCFA) regulations further reduced the flow of credit.

Since then, we’ve observed the market turn quite abruptly; sales volumes fell, while a fresh wave of new listings flooded the market as those considering sale had little incentive to hold with prices falling.

Where we are now

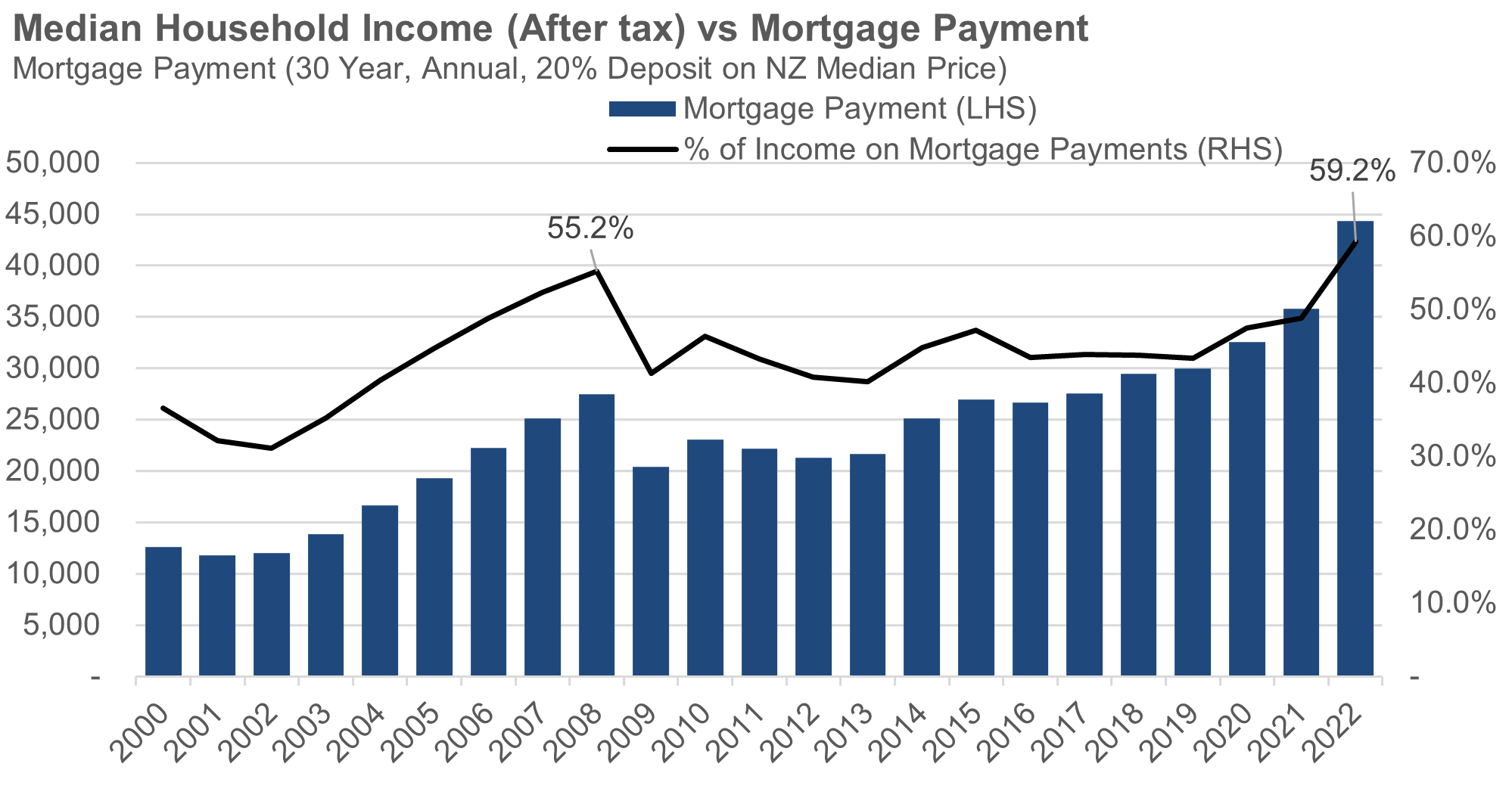

Most mortgage rates are now higher than they were in March 2020 and it appears they’ll continue rising quickly. With house prices some 35-40% higher than they were then, new loan servicing is consuming a much larger share of household incomes.

The chart below illustrates the size of annual mortgage payments over time, for a purchase at New Zealand’s median house price, assuming a 20% deposit, 30-year term, and the prevailing two-year fixed mortgage rate. At the median price in February 2022 of $885,000, annual mortgage payments would be ~$45,000. The share of after-tax median income (black line) required to service these mortgage payments is currently at an all-time high of ~59% of income, with the last peak being in 2008. Of course, this analysis does not consider any other costs of home ownership, many of which are also rising quickly.

Where to from here?

The economic backdrop has shifted rapidly; New Zealand is seeing weaker GDP growth, rising interest rates, and falling asset prices. At the same time, inflation is at 30-year highs, and likely to exceed 7% this year, putting pressure on household budgets as real incomes fall. Over the next 12 months, circa 70% of mortgages will roll over onto higher mortgage rates, with some rates at nearly double the lows of last year, placing a further squeeze on household cashflow.

Construction sector

Recent shifts have been negative for housing developers and builders. Many have been hit with rapidly escalating materials prices, difficulties sourcing labour, and delays adding uncertainty around project timeframes and costs. Many are now facing falling prices for their end product and eroding profit margins. This is particularly so for those who acquired land at recent elevated prices or have fewer pre-sales banked.

Rising costs and falling end prices send a signal for developers to reduce the volume of housing supply they bring to market. We expect creditors may also pull back their lending to the sector as the outlook weakens. A significant correction in dwelling consents from current levels is likely through the balance of the year, while a chunk of the recently consented projects will be paused, perhaps indefinitely in cases.

Historically, episodes of falling house prices have had a significant impact on new dwelling consents with a lag (note the exception of 2018/19, which was likely affected by the introduction of the Auckland unitary plan, which increased the permitted density of housing development). In 2008/09 we saw a 13.2% cumulative fall in house prices and a subsequent 53% fall in building consents. In the late 90s we saw an 11.2% cumulative fall in prices and a 18% fall in dwelling consents; the tech crash in 2000 saw prices fall 5.5% with consents dropping 36% from their peak.

Past experience suggests a fall in consents in the order of 20-50% over the next 12 to 18 months as the housing market correction continues. Caution may be warranted on the outlook for firms in the building sector whose earnings are exposed to weaker construction activity and a stalling in development projects as commercial and residential markets find a new equilibrium. This should ease capacity constraints and cost pressures and provide encouraging news for those who have struggled to secure a builder.

House prices

Amendments to the CCCFA rules should improve the flow of credit for buyers but borrowing capacity has been falling since November. Savings rates will likely decline as international travel resumes, mortgage costs rise, and inflation eats up more of household earnings. Interest rates are likely to continue on an upward track, boosting the returns from deposits and other income-generating assets. With that, we see risk around the sustainability of recent/aggressive price increases by aged care operators, some of which report having raised unit prices at their villages in the order 20%+ over the past 12 months.

We think the impact of migration on house prices over the short to medium term will be limited, noting the near-zero levels of net migration into New Zealand over the past two years and the subsequent 40% increase in prices, despite record building activity.

We think rental markets are a better measure of the physical demand and supply balance. Rents have been rising but at levels nothing close to the change in house prices, which are more closely related to the cost and availability of credit.

The Reserve Bank of New Zealand and other central banks are potentially well behind the curve. Interest rates need to move higher in order to control inflationary pressures. High inflation, rising interest rates, falling real incomes, a surge in new listings, and an exceptionally high starting point for valuations are creating the perfect storm for house prices.

With worsening fundamentals, the market looks fragile, with a correction from the November peak in the order of 15-20% easily justified, before returning to a more normal growth trajectory. This is potentially a welcome relief for aspiring first-home buyers and families who have seen the housing ladder move out of reach.

Sources: RBNZ, REINZ, Statistics New Zealand

Tobias Newton is an equity analyst at Octagon Asset Management. This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice.

This is not a recommendation to buy or sell any financial product and does not take your personal circumstances into account. All opinions reflect Octagon Asset Management judgement on the date of communication and may change without notice. Past performance is not a reliable guide to future performance.

We recommend you take financial advice before making investment decisions. We have prepared this web page in good faith based on information obtained from other sources, but we do not guarantee the accuracy of that information. We do not make any representation or warranty (express or implied) that this web page is accurate, complete, or current and to the maximum extent permitted by law disclaim any liability for loss which may be incurred by any person relying on this web page.