First Home Grant

To help you buy your first home you may be able to get a one-off contribution from Kāinga Ora - Homes and Communities.

There are a few rules around how long you have been contributing to KiwiSaver, plus income and regional house price caps. You may also need to have a minimum deposit.

Even if you have previously owned a home, you may still be able to get this one-off contribution.

How much could I be eligible for?

The First Home Grant offers eligible home buyers up to $5,000 per person to buy an existing house (built and certified more than 12 months ago), and up to $10,000 per person for the purchase or build of a new home.

Purchasing an existing/older house

If you are purchasing an existing/older house you can get $1,000 per year for every year you have been contributing to your KiwiSaver account, up to $5,000.

| KiwSaver Contributions | Per person |

|---|---|

| 3 years | $3,000 |

| 4 years | $4,000 |

| 5 years | $5,000 |

Purchasing or building a new house

If you are purchasing or building a new house you can get $2,000 per year for every year you have been contributing to your KiwiSaver account, up to $10,000.

| KiwSaver Contributions | Per person |

|---|---|

| 3 years | $6,000 |

| 4 years | $8,000 |

| 5 years | $10,000 |

What's the process?

Found your dream home already

If you have already found a house, and have a signed sale and purchase agreement, apply for approval through Kāinga Ora - Homes and Communities by completing the application form. Your application must be completed at least 4 weeks before settlement or they may not pay out the grant.

The First Home Grant is paid directly to your solicitor prior to settlement day.

Still looking for your dream home

Even if you haven’t found a house you’d like to buy, you can still apply for a First Home Grant pre-approval through Kāinga Ora - Homes and Communities by completing the application form.

Once you have found a house you can complete the process. Your pre-approval will be valid for 180 days, and after that time you will need to re-apply.

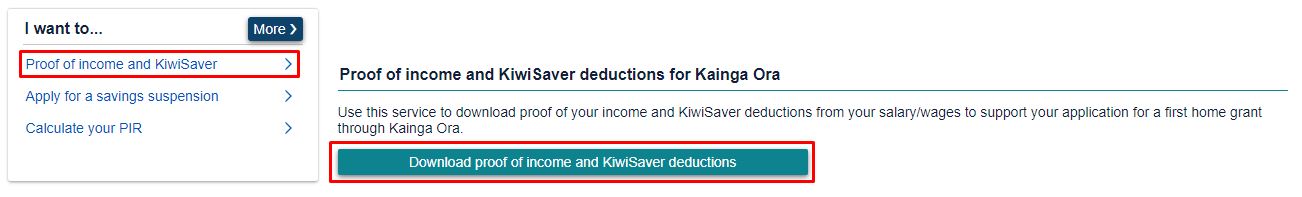

Need proof of income and KiwiSaver deductions to support an application for a one-off contribution from Homes and Communities?

Login to your myIR account and click the “Proof of income and KiwiSaver” within the “I want to…” section at the top right, then click the download button for a PDF for the applicable information.

Am I eligible for a First Home Grant?

There are a number of eligibility criteria for the First Home Grant.

You must be 18 years or over and have contributed at least the minimum allowable amount of your total income to a KiwiSaver scheme, complying fund or exempt employer scheme regularly for at least three years.

A minimum deposit of 5% is required and there are rules around the type of property you are purchasing, whether you are a single buyer or purchasing with a group and if it is an existing property or new build.

Income and regional house price caps also apply. Income caps are outlined in the table below. For current regional house price caps please visit the Kāinga Ora website.

You can view the complete list of criteria to see if you’re eligible for a First Home Grant by visiting the Kāinga Ora website.

Previous home owners may still be eligible for a First Home Grant, however there are additional criteria around being in the same financial position as a first home buyer.

Income caps

| Number of buyers |

Income (before tax) in the last 12 months |

|---|---|

| Single buyer | $95,000 or less |

| Single buyer with one or more dependents | $150,000 or less |

| Two or more buyers, regardless of the number of dependents | Combined income of $150,000 or less |