Accessing KiwiSaver information via myIR

Click the "myIR login button" and enter your login details:

Within the KiwiSaver member account section of this summary tab you will find information such as which KiwiSaver scheme you are, whether you are currently on a savings suspension and links to further information.

Contributions summary

The contributions summary subsection defaults to the latest Government contribution year, which can help you determine what level of top up may be required if you have not yet contributed enough to receive your maximum Government contribution.

If you need further transaction detail simply click "View transactions".

Please note that the contribution information held at Inland Revenue may differ slightly from the information you see when you log in to your Summer KiwiSaver scheme account. This may be because some contributions are yet to come through from Inland Revenue to your Summer account or if you have made a voluntary contribution directly through your KiwiSaver provider, whether the Summer KiwiSaver scheme or a previous scheme.

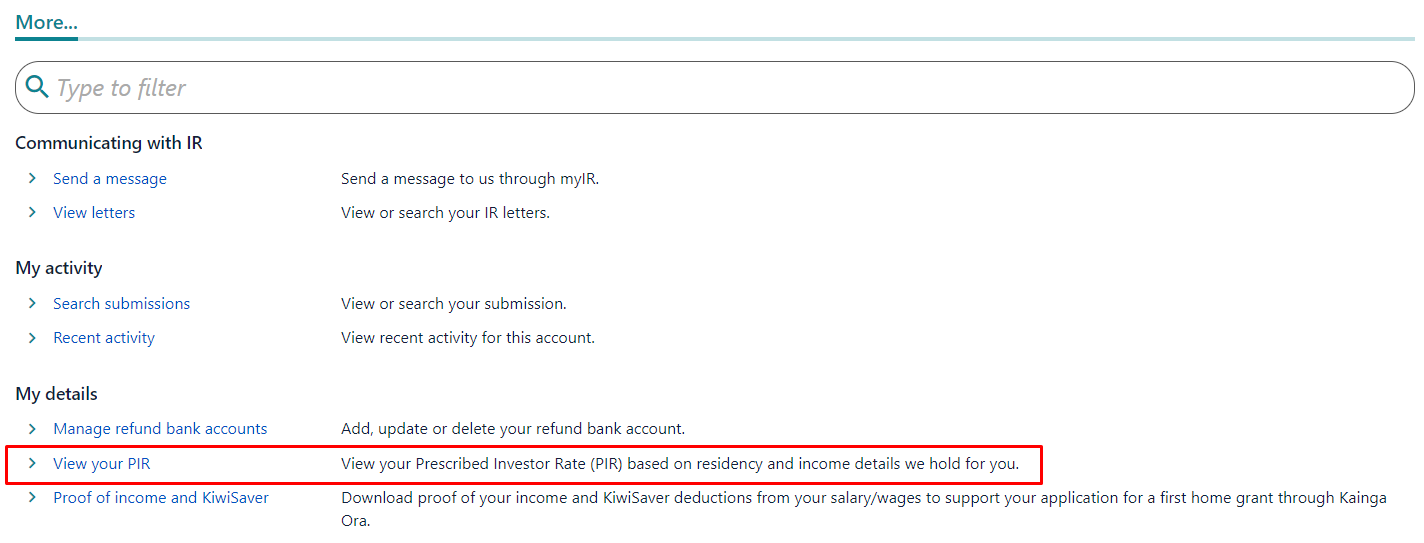

Prescribed Investor Rate (PIR)

MyIR also allows you to maintain your contact details with IRD and check what IRD have calculated your Prescribed Investor Rate (PIR) to be.

To check your PIR via MyIR once logged in click "More" within KiwiSaver member account (screenshot above) then "View my PIR" under My details.

This will display your calculated PIR, based on the income records for the last 2 years that Inland Revenue hold for you.

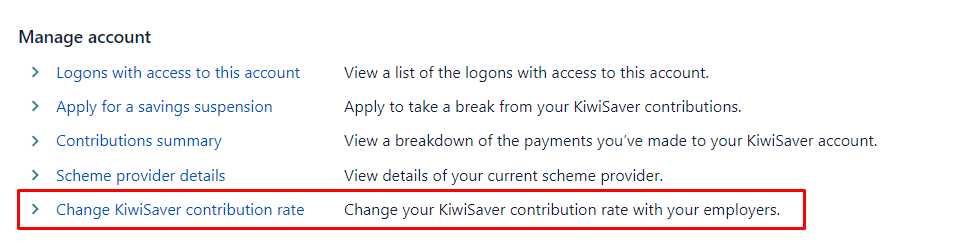

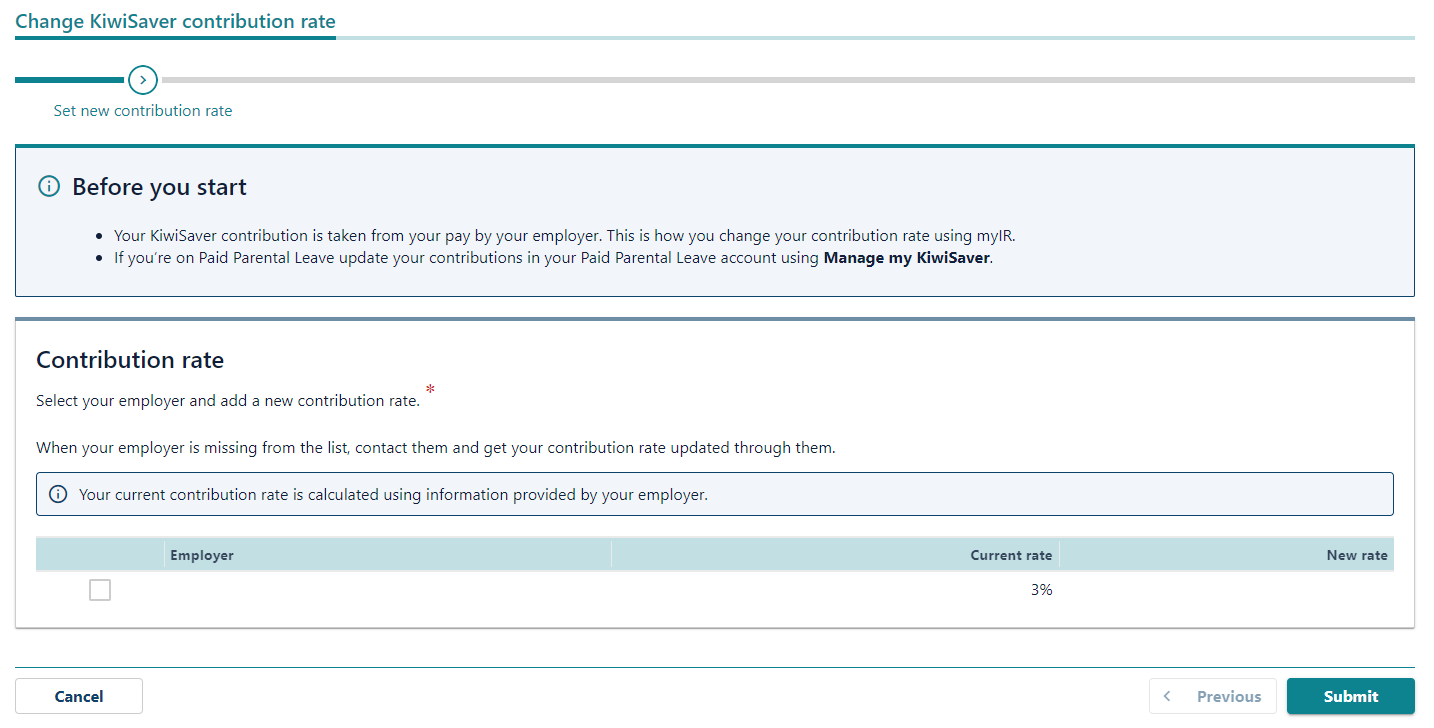

Changing your contribution rate

To change your contribution rate via MyIR once logged in click “More” within KiwiSaver member account (screenshot above) then "Change KiwiSaver contribution rate" under Manage account.

Here you can see your current contribution rate, which is calculated using information provided by your employer, as well as select and submit a new rate.

If you have any questions about accessing your KiwiSaver information through myIR, please contact us.