Investors should seek out best risk-adjusted returns

Paul Robertshawe and Christine Smith-Han

Chief Investment Officer and Equity and Strategy Analyst, Octagon Asset Management

First published by NBR on 31 October 2023

ANALYSIS: More choices generally allow active managers to exhibit their skill level over time, versus short-term periods of good or bad luck.

Diversification is the great free lunch in investing – a simple way to get a better return for risk. Typically, we talk about diversification across asset classes – eg, between things such as equities, bonds, commodities, private equity, and the like – and then, within each of those subcategories, you can break the asset class down further (local vs global), and then further again into individual security selection.

For New Zealand retail product definitions prescribed by the FMA, there is a peculiar breakdown of the equities asset class. There is no specific New Zealand equities asset allocation, despite the tax advantages afforded by imputation, and instead there is a broader breakdown simply called ‘Australasian Equities’.

The New Zealand equity market is small and it is not representative of large chunks of the actual economy – for example, supermarkets, commodities, technology, and the finance industry are not fully represented on the NZX. The New Zealand equity market also has a high proportion of defensive stocks – think regulated utilities such as Vector, Chorus, and Auckland Airport; energy generators such as Meridian and Contact; and other defensive earners such as telecoms and seaports.

The Australian equity market is also relatively small in the global context, but materially larger and more diversified than New Zealand’s market. It has much greater exposure to the sectors missing from the New Zealand market, especially listed domestic banks, and more companies in each industry to choose from.

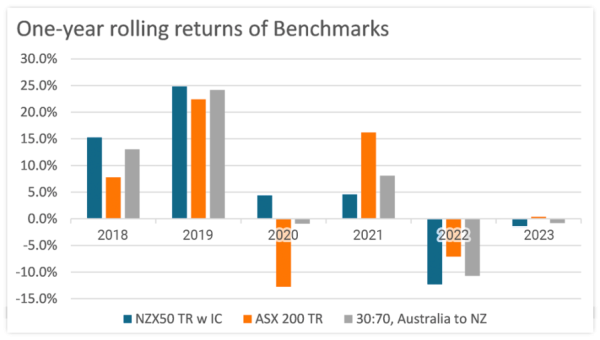

This is well illustrated by noting that, over the past five years, Australia has a beta of 0.73, higher than NZ equities beta of 0.49 to global equities. Beta is a measure of relative volatility frequently used to compare the volatility (ups and downs) of two assets (or an asset with a market, or between two markets as we have done here). With a higher beta, you would hope to get a higher medium-term return, albeit with higher volatility. There have, however, been significant periods where NZ equities have outperformed Australian equities and we need to think about this using a long investment horizon.

Despite these different betas, the New Zealand and Australian economies and economic cycles are reasonably high, correlated at 0.81.

More choices generally allow active managers to exhibit their skill level over time, versus short-term periods of good or bad luck. The more frequently you make a choice, the more statistically significant it is when you get it right (or wrong)!

This means an investment process – and the skilled individuals that make those choices – can shine through the monthly, quarterly, or annual volatility of markets. Never forget that stock picking involves making assumptions about the future, and no-one will be right all of the time.

Passive/active investment

This discussion largely ignores adopting a passive investment approach based on selection of a benchmark(s) and replicating it (them). That becomes an asset allocation decision and there will be many managers who can implement that decision cheaply to achieve that investment goal.

Active management generally comes at a higher cost than passive approaches, so we need to know we are getting value for our higher fees.

There are two key ways of achieving an actively managed exposure to Australasian equities.

First, you could define an allocation to each market and tilt that allocation through time based on the relative valuation and economic backdrops (if you want to). Under this approach, you will likely choose a manager for NZ equities against a NZ benchmark, and a manager for Australia against an Australian benchmark. We believe this provides the greatest level of clarity, consistency, and client satisfaction and flexibility.

Alternatively, an approach commonly used is to pick one manager to run an Australasian portfolio including stocks from both markets in a single fund, allowing them to choose and flex the allocation to Australia. In this case, manager performance is often measured against a New Zealand-only equity benchmark such as the S&P NZX50 even though Australian equities have historically been significant proportions of the Australasian equities portfolio.

This second approach is where the tricky part comes in. Active managers are selected because the investor thinks they can add value against a benchmark – a benchmark that a low-cost passive manager could replicate. How do we measure performance when we allow our manager significant flexibility outside of the benchmark? Flexibility outside a benchmark by definition means at times they significantly underweight the benchmark exposures.

We can look at the investment process and team depth, to satisfy ourselves that the team and its philosophy is appropriate for both markets and well-resourced to achieve our investment objectives. We can look at the track record, volatility of historic returns and team stability. We can also look at breaking down returns between asset allocation – the proportion in NZ versus Australia by recalculating the benchmark return using market returns for each proportion – and stock picking.

Recalculating the benchmark allows us to identify the active return in two buckets. The beta bucket (the market return), and the alpha bucket. The managers’ return is comprised of asset allocation return and stock selection return. De minimis allocation to Australia is neither here nor there on stocks held outside of NZ benchmark but, at some point, that needs to be broken down into asset allocation and stock selection.

Important piece of work

This can be an important piece of work – perhaps a manager is particularly good at picking times when the Australian market will outperform the New Zealand market. Or perhaps the manager is good at picking individual stocks, but not the relative performance of the two markets. Of course, we are looking to find a manager good at both.

Knowing this breakdown of returns should allow us to select the best approach to managing active Australasian equities.

If we choose an Australasian manager with a NZ benchmark, it should allow us to choose managers who are adding value through skillful application of their process to both the proportion of Australian stocks in the fund, and the stock choices across both markets.

A third but less common option might be to choose an absolute return target for Australasian equities; we still need to find a way to evaluate manager performance on a risk-adjusted basis. Benchmark selection becomes difficult and nuanced in that scenario, but we still want to know – is the manager achieving the absolute return in the least-risky and lowest-cost way, or are we exposing ourselves to risks and costs that aren’t apparent by just looking at returns?

A custom benchmark might be appropriate – but it needs to be clearly defined with rules around new entrants coming in and existing members dropping out. It needs to be liquid and replicable at reasonable cost too, and constantly rebalanced. This can be an expensive exercise, so a cost/benefit analysis versus adopting a well-established and publicly available benchmark should probably be done.

All investors should be seeking out is the best risk-adjusted returns. Part of that process is making sure you assess the skills of the manager(s) in the right way, and against the right benchmark.

Disclaimer: This article has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. This article does not contain financial advice. This article was supplied to NBR and first published 31 October 2023.

This is not a recommendation to buy or sell any financial product and does not take your personal circumstances into account. All opinions reflect Octagon Asset Management judgement on the date of communication and may change without notice. Past performance is not a reliable guide to future performance.

We recommend you take financial advice before making investment decisions. We have prepared this web page in good faith based on information obtained from other sources, but we do not guarantee the accuracy of that information. We do not make any representation or warranty (express or implied) that this web page is accurate, complete, or current and to the maximum extent permitted by law disclaim any liability for loss which may be incurred by any person relying on this web page.