Quarterly Market Comment

As an active fund manager, Octagon Asset Management prioritises high-quality research as an input to decision making. It draws on research from a range of sources, local and global. This includes research provided by Forsyth Barr. Below is its most recent Quarterly Market Comment.

Quarterly Market Comment

For the quarter ended 28 February 2026

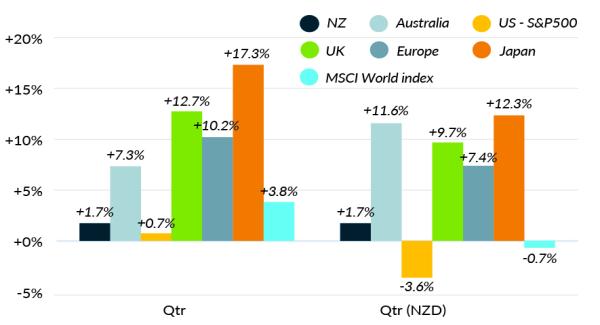

- The past three months have seen the MSCI World Index gain +3.8% in US dollar terms, but a stronger New Zealand dollar meant local currency returns dropped -0.7%.

- Market performance has been mixed across regions, with returns outside the US generally stronger. European and UK equities generally delivered positive gains; NZ equities rose +1.7%; Australian equities lifted +7.3% over the quarter.

- Fixed income returns were solid. NZ investment-grade corporate bonds gained +1.2% for the quarter; 12-month returns were +6%.

Markets shift gears in a more volatile start to 2026

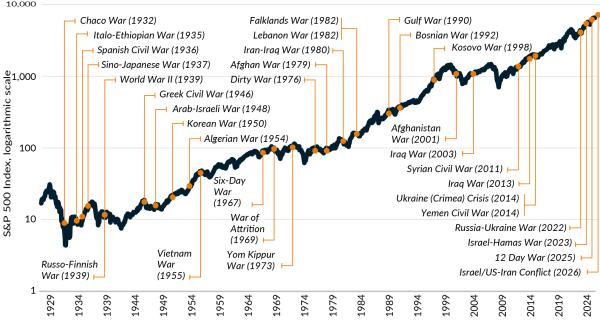

The end of 2025 and the start of 2026 have given investors plenty to digest. Geopolitical tensions have resurfaced across several regions—most recently the conflict involving the US, Israel, and Iran—while US trade policy has returned to the headlines. At the same time, companies exposed to artificial intelligence (AI) themes have come under closer scrutiny. Against this backdrop, markets have experienced periods of heightened volatility.

A key development has been shifting market leadership. For several years, a small group of large US companies generated a substantial share of global equity returns. Those businesses attracted waves of enthusiasm, interspersed with bouts of caution—a pattern that has characterised markets in recent years. More recently, technology shares, particularly those linked to AI, have faced a more challenging period. Markets are reassessing the pace of AI adoption and its broader implications, especially in sectors where it is viewed as a potential competitive threat. As these US market leaders have pulled back, equity markets outside the United States have begun to deliver relatively stronger returns since the start of the year, following several years of US outperformance.

Returns for major stock markets over the past three months (local currency and New Zealand dollar)

Source: Refinitiv, Forsyth Barr analysis

The US corporate earnings season is now well underway, and results to date have been supportive. Many companies have reported solid profit growth and stable margins, reinforcing confidence in underlying business conditions. While enthusiasm around AI investment remains high, investors have become more selective. They are increasingly rewarding companies that can clearly demonstrate earnings delivery rather than relying solely on long-term growth narratives.

Corporate earnings: Fundamentally sound

Recent company results around the world have generally been encouraging. Profits are holding up well, and many businesses remain confident about the year ahead.

However, market reactions have been mixed—particularly in the technology sector—where expectations have been high. In some cases, even strong results were met with muted share price responses. Despite this, the overall message remains encouraging: corporate balance sheets are sound, and earnings growth continues to provide support for markets.

In Australia, company results were also better than many expected. While performance differed between businesses, overall profits were resilient. Tax cuts, government spending, and population growth are helping support the economy, and expectations for earnings growth in the coming quarters have improved.

It was a similar story during the recent NZ reporting season, where corporate reporting has reinforced the view that the NZ economy continues to improve. The tone of the latest earnings season was more positive than it has been for some time, with many companies pointing to better trading conditions and a cyclical recovery taking hold.

Geopolitically uncertainty elevate again

Tensions in the Middle East escalated at the end of February following coordinated US and Israeli strikes on Iran. Financial markets initially responded cautiously, and oil prices jumped on concerns about supply disruption through the Strait of Hormuz—a critical route for around 20% of global oil shipments and a significant share of natural gas.

At the time of writing, the impact on global equity markets has so far been modest. Historically, conflicts in the region have tended to affect oil prices more than share markets, with equity volatility often proving short-lived unless energy supply disruptions persist.

S&P 500 index and geopolitical events

Source: Refinitiv, Forsyth Barr analysis

US trade policy back in focus

US trade policy came back into focus in February after the Supreme Court ruled that the President had overstepped his authority in imposing broad tariffs using the International Emergency Economic Powers Act (IEEPA). The court ruling limits the US administration’s ability to introduce sweeping tariffs under emergency powers, and a separate decision is still pending on whether ~US$170bn of tariffs previously collected under this authority must be repaid.

In response, the White House pivoted to using another mechanism, which allows temporary tariffs of up to 15% for 150 days without Congressional approval. A broad-based 10% tariff has been introduced, with indications it could rise to 15%. Any extension beyond 150 days would require Congressional approval. Exemptions remain in place for selected goods, including certain agricultural products such as beef. For New Zealand, the overall impact of this change is expected to be modest but helpful for those sectors without exemptions that are exporting to the US.

Some things never change

Markets will continue to evolve, and 2026 will no doubt bring its share of surprises—both positive and negative. As we move further into the year, a few core investing principles remain as relevant as ever:

- Volatility is normal. It is not, on its own, a reason to abandon a well-considered investment plan. Often the best action is to do nothing at all.

- Avoid emotional decision-making. Fear and greed can lead investors to sell after markets fall or chase returns when prices are high—both of which can damage long-term outcomes.

- Beware of FOMO. Overweighting recent performance can distort judgement, particularly around market turning points.

- Focus on your own objectives. Investment decisions should be driven by personal goals, time horizons, and risk tolerance—not market noise.

Matt Henry

Head of Wealth Management Research

Zoe Wallis

Investment Strategist

Not personalised financial advice: The recommendations and opinions in this publication do not take into account your personal financial situation or investment goals. The financial products referred to in this publication may not be suitable for you. If you wish to receive personalised financial advice, please contact your Forsyth Barr Investment Adviser. The value of financial products may go up and down and investors may not get back the full (or any) amount invested. Past performance is not necessarily indicative of future performance.

Disclosure: Forsyth Barr Limited and its related companies (and their respective directors, officers, agents and employees) (“Forsyth Barr”) may have long or short positions or otherwise have interests in the financial products referred to in this publication, and may be directors or officers of, and/or provide (or be intending to provide) investment banking or other services to, the issuer of those financial products (and may receive fees for so acting). Forsyth Barr is not a registered bank within the meaning of the Reserve Bank of New Zealand Act 1989. Forsyth Barr may buy or sell financial products as principal or agent, and in doing so may undertake transactions that are not consistent with any recommendations contained in this publication. Forsyth Barr confirms no inducement has been accepted from the researched entity, whether pecuniary or otherwise, in connection with making any recommendation contained in this publication.

Analyst Disclosure Statement: In preparing this publication the analyst(s) may or may not have a threshold interest in the financial products referred to in this publication. For these purposes a threshold interest is defined as being a holder of more than $50,000 in value or 1% of the financial products on issue, whichever is the lesser. In preparing this publication, non-financial assistance (for example, access to staff or information) may have been provided by the entity being researched.

Disclaimer: This publication has been prepared in good faith based on information obtained from sources believed to be reliable and accurate. However, that information has not been independently verified or investigated by Forsyth Barr. Forsyth Barr does not make any representation or warranty (express or implied) that the information in this publication is accurate or complete, and, to the maximum extent permitted by law, excludes and disclaims any liability (including in negligence) for any loss which may be incurred by any person acting or relying upon any information, analysis, opinion or recommendation in this publication. Forsyth Barr does not undertake to keep current this publication; any opinions or recommendations may change without notice. Any analyses or valuations will typically be based on numerous assumptions; different assumptions may yield materially different results. Nothing in this publication should be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from doing so, or to engage in any other transaction. Other Forsyth Barr business units may hold views different from those in this publication; any such views will generally not be brought to your attention. This publication is not intended to be distributed or made available to any person in any jurisdiction where doing so would constitute a breach of any applicable laws or regulations or would subject Forsyth Barr to any registration or licensing requirement within such jurisdiction.

Terms of use: Copyright Forsyth Barr Limited. You may not redistribute, copy, revise, amend, create a derivative work from, extract data from, or otherwise commercially exploit this publication in any way. By accessing this publication via an electronic platform, you agree that the platform provider may provide Forsyth Barr with information on your readership of the publications available through that platform.