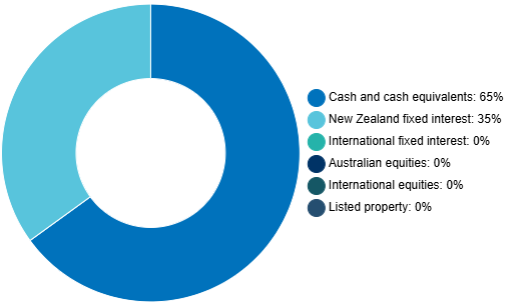

Below we outline a sample defensive asset allocation, we recommend for clients with a 0% risk tolerance. You can use this as a guide in constructing a Defensive portfolio.

Strategic investment mix

| Defensive Profile | Allocated % |

|---|---|

| New Zealand Cash | 65.00% |

| New Zealand Fixed Interest | 35.00% |

| Global Fixed Interest | 0.00% |

| Total income assets | 100.00% |

| New Zealand Equities | 0.00% |

| Australian Equities | 0.00% |

| Global Equities | 0.00% |

| Total growth assets | 0.00% |

| Total portfolio | 100.0% |

Risk indicator

The Financial Markets Authority has provided guidance on indicators which can help describe investment risk. These indicators are based on annualised standard deviations, a mathematical measure of risk.

On a scale of 1 (least risky) to 7 (most risky), the investment risk of the asset sectors can be described as follows:

|

Asset sector |

Risk Indicator |

|

|

Cash |

1 |

Very low volatility |

|

Fixed interest (New Zealand) |

2 |

Low volatility |

|

Fixed interest (Global) |

3 |

Low to medium volatility |

|

New Zealand equities and listed property |

4 |

Medium to high volatility |

|

Global equities |

5 |

High volatility |

|

Australian equities |

6 |

Very high volatility |

The risk profile for a Defensive portfolio can be described as 2 (low volatility).

Performance: Check out the performance information for each fund, which is updated online monthly and read the latest quarterly fund update.